House prices in many parts of Canada have been soaring for years. Mortgages are growing larger and the number of households with extreme levels of debt is multiplying rapidly.

So you’d think that we would be seeing an increase in the number of households that are having a hard time paying off their mortgages.

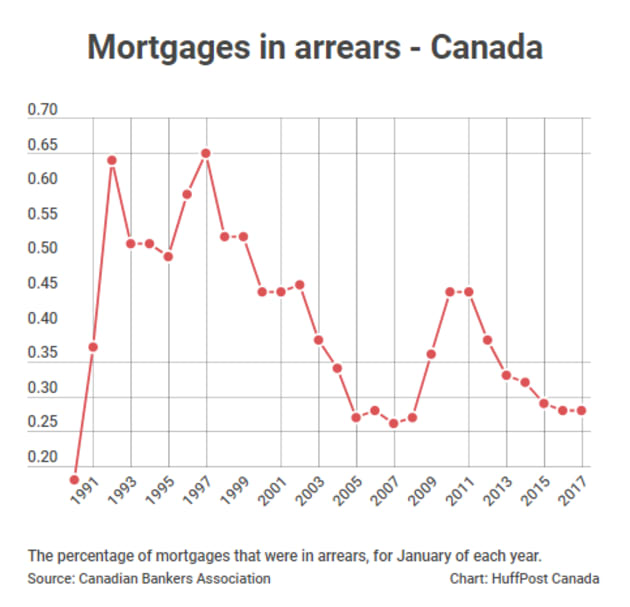

Not so. In fact, the opposite is happening. The rate of mortgages in arrears in Canada has fallen to its lowest in more than a decade. Just 0.24 per cent of mortgages were three months or more past due in November of 2017, the latest month for which data is available, according to the Canadian Bankers Association.

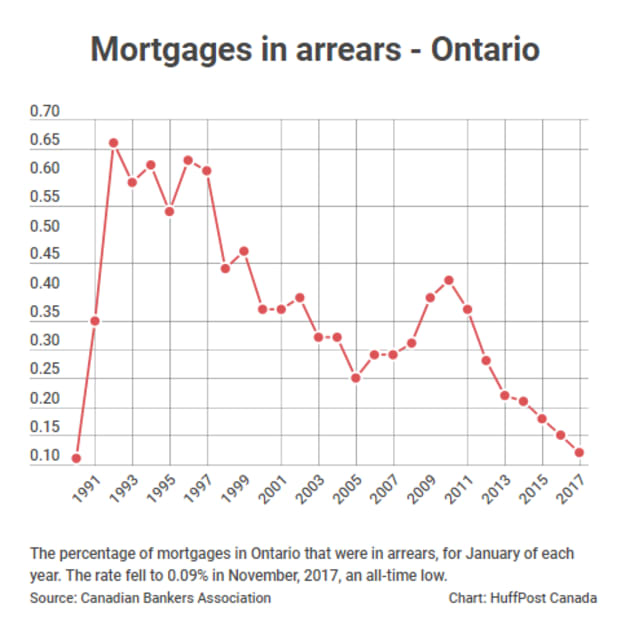

Somehow, the situation is even better in the provinces with the highest house prices. In British Columbia, 0.16 per cent of mortgages were in arrears, the lowest since 2008. And in Ontario, the arrears rate is at an all-time low — a tiny 0.09 per cent.

In other words, just about everyone is making their payments.

There are a number of reasons for this. First and foremost, mortgage rates have been at or near record lows for almost the past decade, helping to keep mortgage payments stable even as house prices rose. We may be taking out huge mortgages, but we’re making relatively small payments on them.

Another likely reason is the 2016 tightening of mortgage rules for those who put down less than 20 per cent. These highest-risk borrowers now have to pass a stress test to ensure they can afford higher rates. So in theory, the most recent crop of borrowers should be better able to handle their debt.

>>Continue Reading HERE